NatWest Group

Secondment via Sapient (Agency)

🏧

NatWest Group is the largest business and commercial bank in the UK, with a leading retail business. Owning NatWest, Royal Bank of Scotland, Ulster Bank and Coutts, the NatWest Groups’ purpose is championing potential, helping people, families and businesses to thrive.

Platform

💻 Web

Quick links:

Objective Strategy

Process Research & UX

Designs UI

Tests & Findings Data

Objective Strategy

Adopt a white label approach to designing components that will be used across NatWest and Royal Bank of Scotland, maintaining the consistency in UX but specificity in UI.

Increase the percentage of successfully completed online applications by 20%, across products such us credit cards, mortgages and bank accounts - Personal and Business.

Process Research & UX

Analytics and extensive user research showed that many customers of NatWest and Royal Bank of Scotland found it difficult to apply for products online. They began an application form and either did not return to complete it, or finished opening an account (for example) in a physical location. A recurring pain point was that many felt they “wasted more time searching for the right information and documents needed” rather than progressing their application. This made them feel worried about making mistakes and reluctant to continue.

Opening a bank account or applying for a mortgage is a sensitive process, so we wanted to treat it as such, allowing our customers to feel the same support digitally as they would one-to-on, in branch, with an advisor. We tackled this problem using ‘progressive disclosure’ - a design pattern focussed on releasing information step-by-step. This allowed us to:

Personify our application using each brand’s tone of voice, mimicking an in-branch experience with an advisor

Offer the right information at the right time, based on our customers' input.

Create a hub for specific documents to live

Guide customers through a long and important process, reducing cognitive overload and anxiety

Through rapid prototyping and guerrilla testing in the office, we identified that although we would need to streamline our application forms, a quick win to meet our goal could be achieved through a ‘pre-application filter’. This filter would tell customers which documents they’d need before starting, based on the application they’re making. We branded this self-contained experience ‘Ready to Apply’.

Designs UI

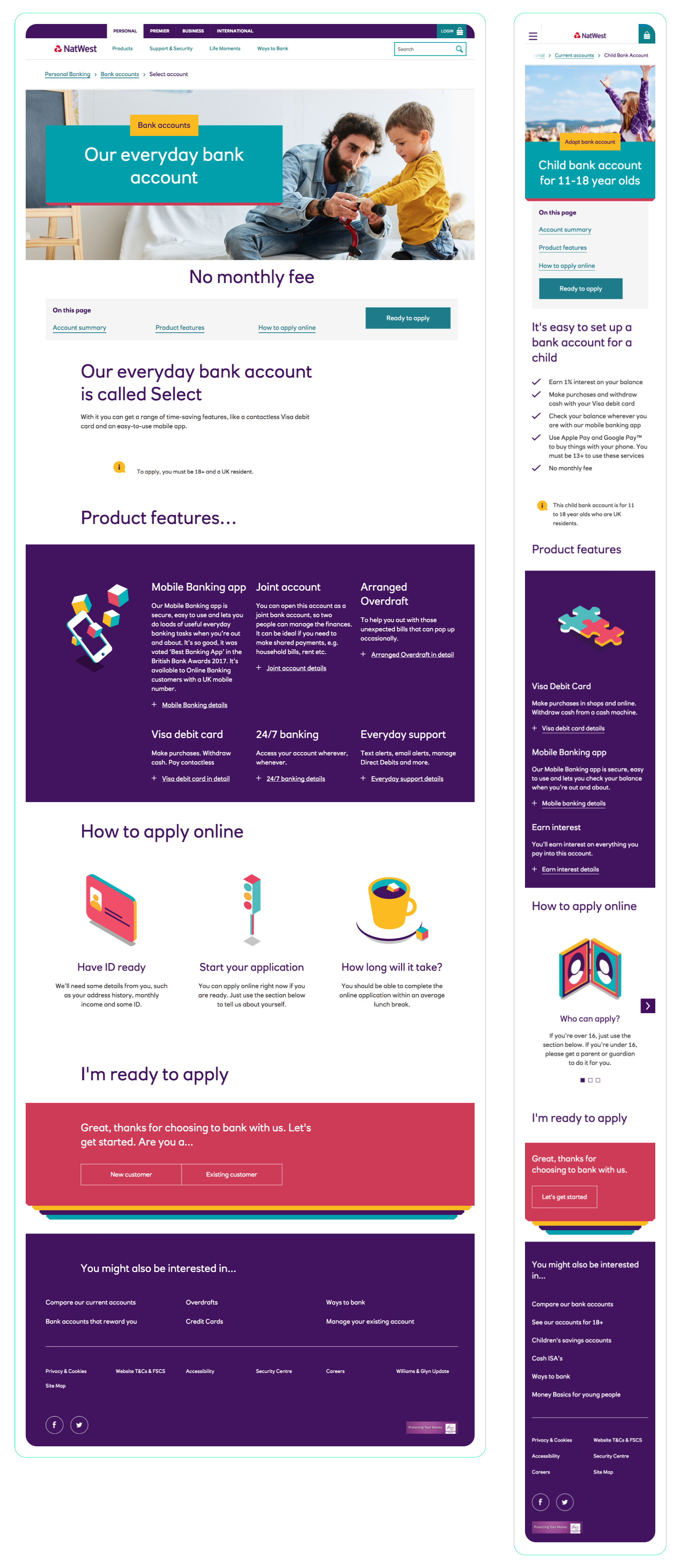

Desktop (1024px) and mobile (375px)

‘Progressive disclosure’ for every product

…and for every brand.

Tests & Findings Data

Through A/B Testing in production, ‘Ready to Apply’ significantly met our key objectives:

To reduce cognitive overload and anxiety

A scalable solution for all products across NatWest and Royal Bank of Scotland

Reduce the percentage of incomplete applications

3 months after release, analytics showed that ‘Ready to Apply’ reduced unfinished applications by 48%.